Nvidia and Taiwan Semiconductor Manufacturing (TSMC) are set to dominate AI investing with massive growth on the horizon. Both companies are riding the wave of record spending on AI data centers expected in 2025 and beyond.

Nvidia GPUs power AI training clusters, sometimes with 100,000+ GPUs working in parallel. The surge in AI data center builds means Nvidia’s GPU sales will stay strong for years. Despite a setback in April when the U.S. revoked Nvidia’s export license for its H20 chips—costing an estimated $8 billion in Q2 sales—Nvidia is reapplying and expects approval soon. This should boost sales again, helping Nvidia maintain rapid revenue growth.

Nvidia expects 50% revenue growth in Q2 2024, though it would have been 77% if the H20 sales license had not been revoked. This signals tough market growth despite challenges.

"Nvidia’s massive data center GPU sales are likely to continue."

"Nvidia announced that it is reapplying for an export license and has assurances from the U.S. government that it will be approved."

"While Nvidia expects 50% revenue growth in Q2, that number would have been 77% if projected H20 sales were included."

See Nvidia’s quarterly operating revenue growth:

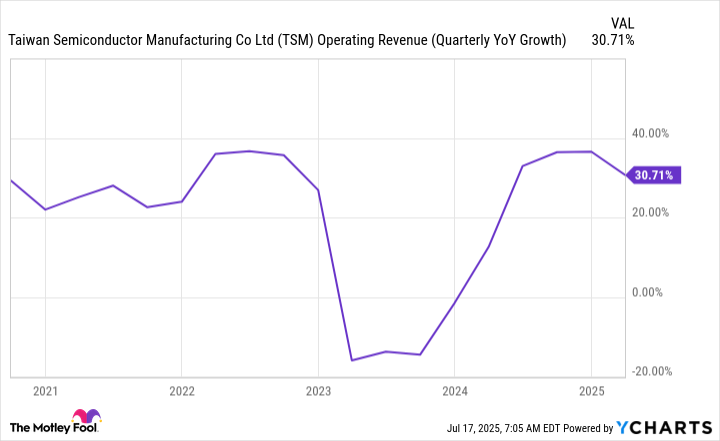

TSMC makes the chips Nvidia designs along with clients like Apple and Broadcom. TSMC dominates because it focuses strictly on chip manufacturing, doesn’t compete with its customers, and leads in production tech. Its 3nm chip yields hit around 90%, leaving Samsung’s 50% far behind.

TSMC has orders booked years ahead, giving it solid visibility on future demand. It predicts AI-related revenue will grow 45% annually from 2025 over five years. Overall revenue growth is expected near 20% annually.

"Management expects AI-related revenue to grow at a 45% compounded annual growth rate (CAGR)."

"TSMC serves more customers than just AI-centric ones, but it still projects its total revenue to grow at a CAGR of nearly 20%."

See TSMC’s quarterly operating revenue growth:

Nvidia and TSMC are top plays for investors betting on AI’s future. Both expect huge, sustained growth that could outperform the market over the next several years.