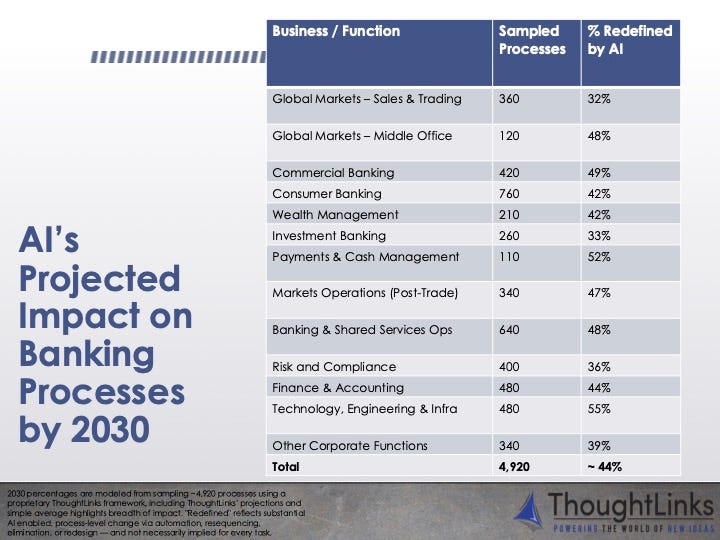

ThoughtLinks says AI will redefine 44% of banking work by 2030.

The independent consulting firm mapped nearly 5,000 banking processes to find out which sectors face the biggest shakeups. Tech, engineering, and infrastructure top the list, with 55% of work set to change. Commercial banking could see 49% redefined. Wealth management, 42%. Investment banking, 33%.

Wall Street is already moving fast. JPMorgan rolled out an LLM suite to 200,000 employees. Goldman Sachs launched GS AI Assistant. Citigroup announced a new AI leadership team last week.

These figures don’t predict job losses or gains. They show how much of the work will be done differently with AI, via automation, redesign, or elimination.

Sumeet Chabria, ThoughtLinks CEO and Wall Street veteran, says understanding job details is key to retraining workers. He broke down AI’s impact on commercial banking, investment banking, and wealth management.

Commercial banking: 49% AI redefined by 2030

Already automated:

- AI copilot services assist bankers with client insights, notes summaries, memos, and spotting policy exceptions.

- Manual workflows like spreadsheets, emails, and legacy systems are getting automated to cut errors.

- Clients access AI assistants for personalized insights and faster routine transactions.

Coming by 2030:

- AI will guide onboarding, verify forms, and assess risks.

- Creditworthiness assessment AI will help expand small business credit.

- AI adjusts loan pricing, fees, and terms based on behavior and market data.

- Real-time AI security alerts will improve breach detection.

Still human:

- Large corporate lending requires human credit judgment and board approval.

- Legal, tax, risk, and structuring teams stay essential.

Investment banking: 33% AI redefined by 2030

Already automated:

- Drafting pitchbooks and prospectuses is AI-assisted, pulling market data and past deals in minutes.

- Internal AI copilots summarize earnings calls, analyst reports, and financials.

- AI reviews documents, flags missing disclosures, and summarizes regulations.

Coming by 2030:

- AI simulates investor demand and models pricing for equity and debt offerings (human-led final allocation).

- AI helps structure deals by testing debt, equity, pricing, and covenants.

Still human:

- Final IPO pricing requires human judgment and market feel.

- Winning mandates and C-suite advising remain relationship-driven.

Wealth management: 42% AI redefined by 2030

Already automated:

- AI copilots answer questions, prep meetings, and summarize portfolios instantly.

- Generative AI accelerates personalized financial plans.

- Client reporting now includes customized commentary on performance and risks.

Coming by 2030:

- More automated, timely tax management.

- AI will tailor advice and investment strategies to individual goals and behavior.

- Clients might manage wealth using AI-driven smart triggers.

Still human:

- Client coaching and engagement for market downturns and personal events requires empathy.

- Regulators insist advisors remain responsible for advice, not AI.

Sumeet Chabria stated:

"Clearly, you’ve got to keep the level of agility,

because things are going to change."

Courtesy of Sumeet Chabria/ThoughtLinks

Courtesy of ThoughtLinks