Generative AI startups are hitting sky-high revenue faster than ever

The golden era of AI startup growth is here. Companies like Lovable scored $50 million in six months. Cursor hit $100 million in its first year. Gamma reached $50 million on less than $25 million raised.

But what about the average AI startup? Old rules don’t apply. Pre-AI, $1 million ARR in year one was top-tier for enterprise startups. Consumer apps often waited years to monetize through ads.

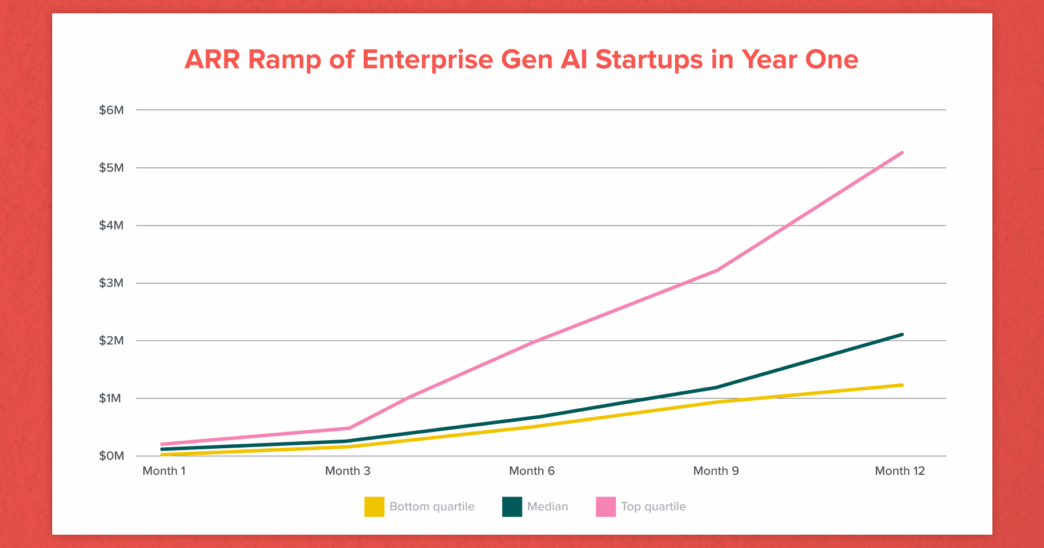

New data from hundreds of AI companies flips that script:

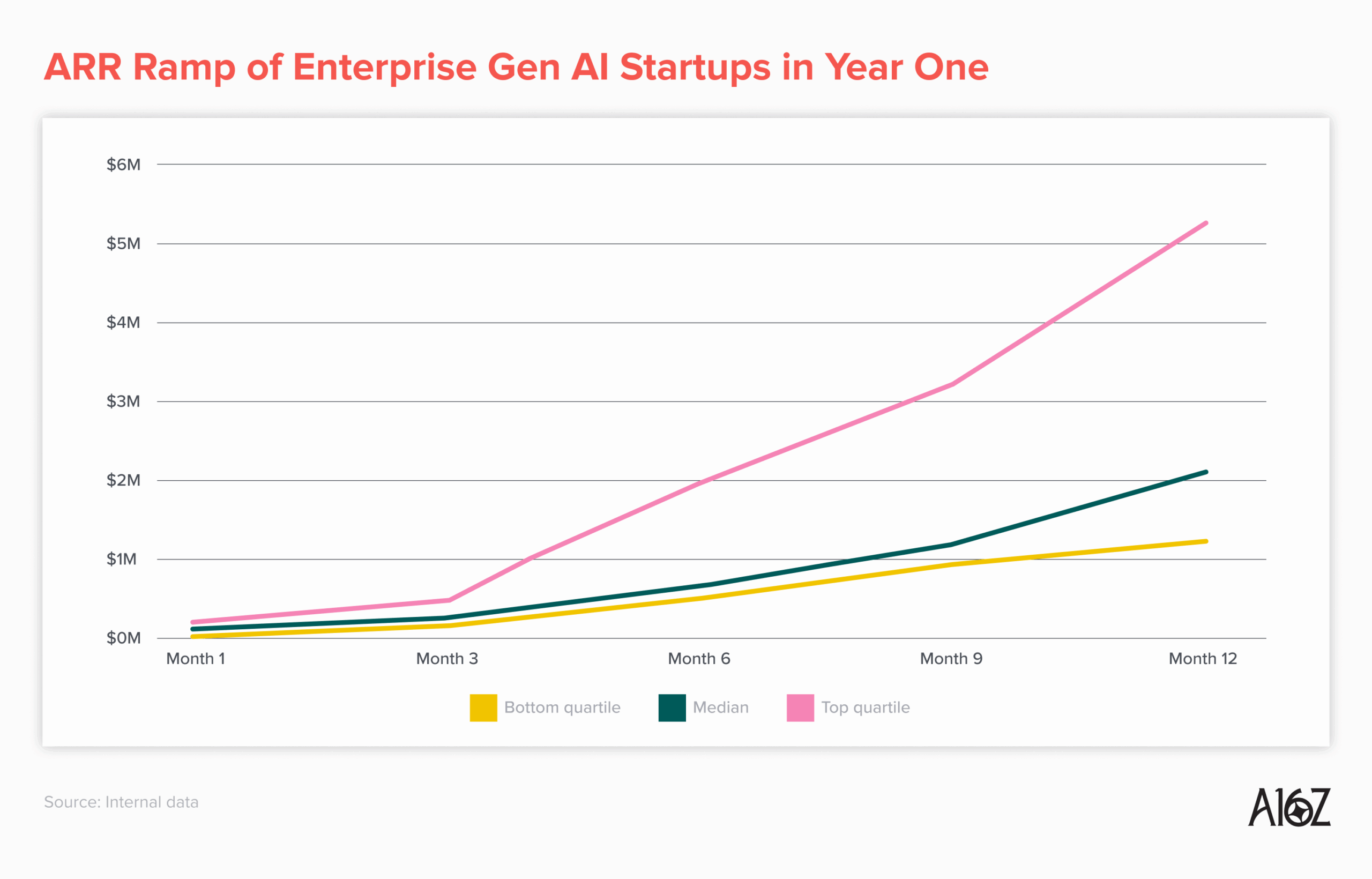

- Median enterprise AI startups now pass $2 million ARR in year one.

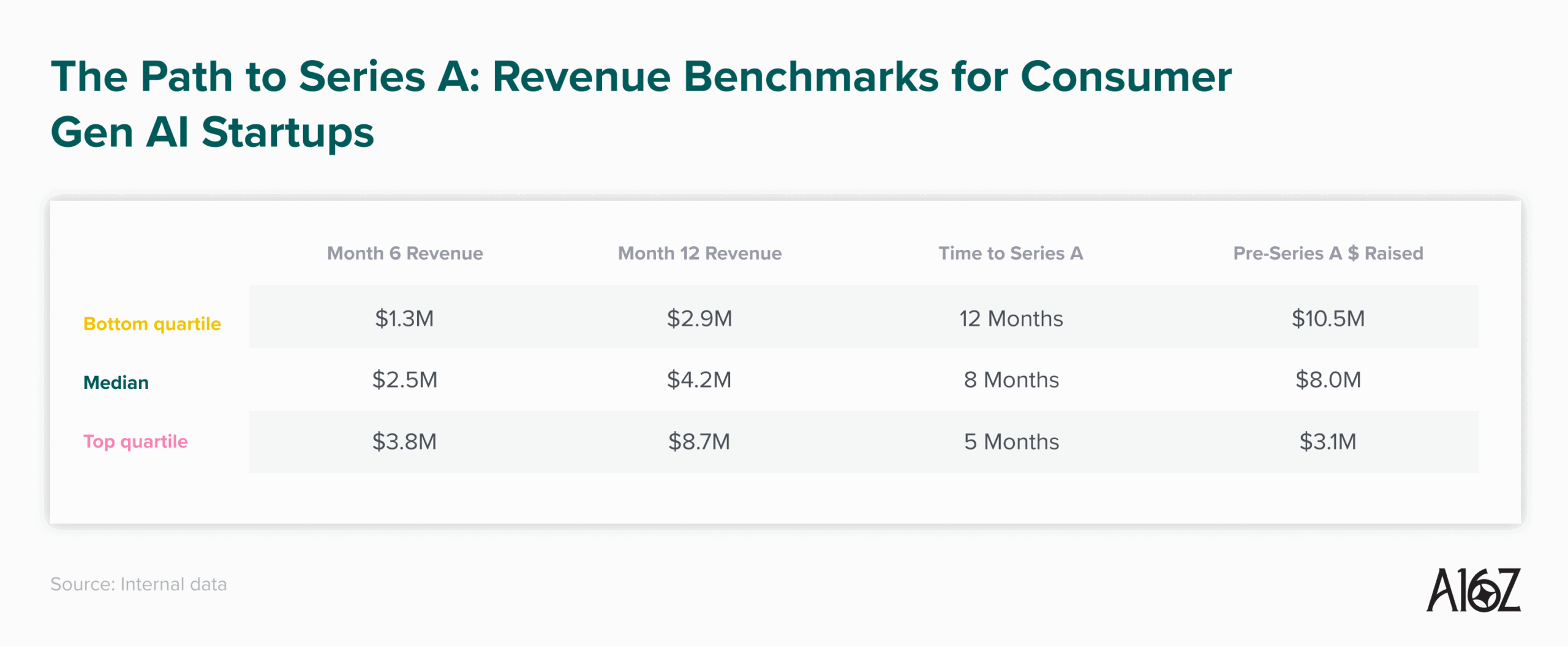

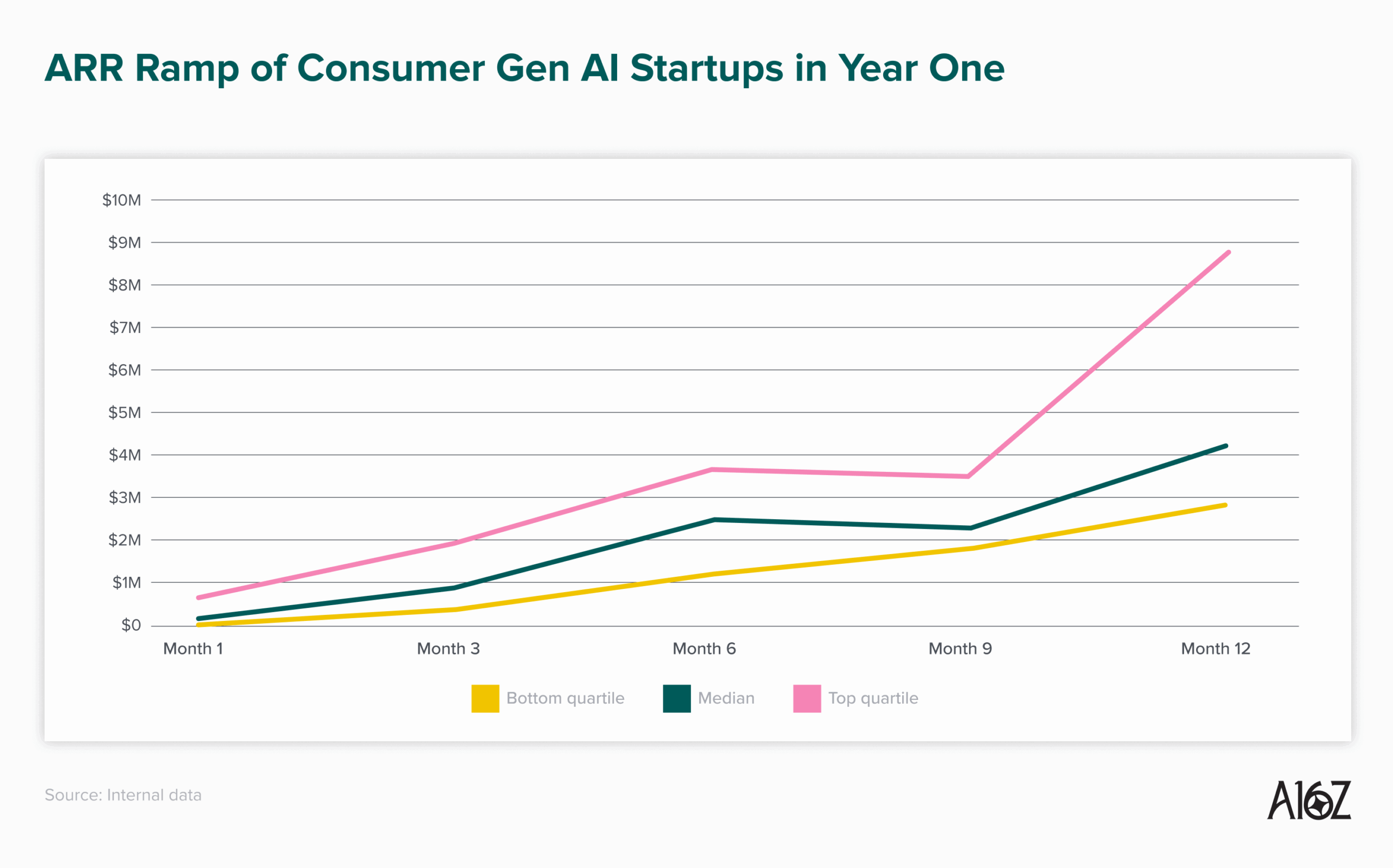

- Median consumer startups hit $4.2 million ARR, raising Series A in eight months.

- The $0-$1 million ARR mark is now low-end growth.

The pressure’s on. If you’re raising rounds, you need speed—fast monetization or rapid product launches are non-negotiable. Speed equals competitive edge.

Top performers don’t just grow fast—they accelerate through year one, breaking away from the pack. Investors want more than revenue; they want strong retention and low churn. Rapid growth won’t excuse poor user engagement.

Consumer AI companies are proving they can be real revenue machines. About a third raised significant funds to build their own models, leading to jumpy revenue spikes with new releases. Conversion rates might be lower than pre-AI apps, but once users pay, they stick around.

Startups are working faster than ever, and both businesses and consumers are showing high willingness to pay for new products.

After combing through the data, we believe there’s never been a better time to build an application-layer software company.

The AI startup landscape just rewrote the growth playbook. Faster ARR, quicker funding rounds, and sharper divides between “good” and “great.” This is the new speed race.