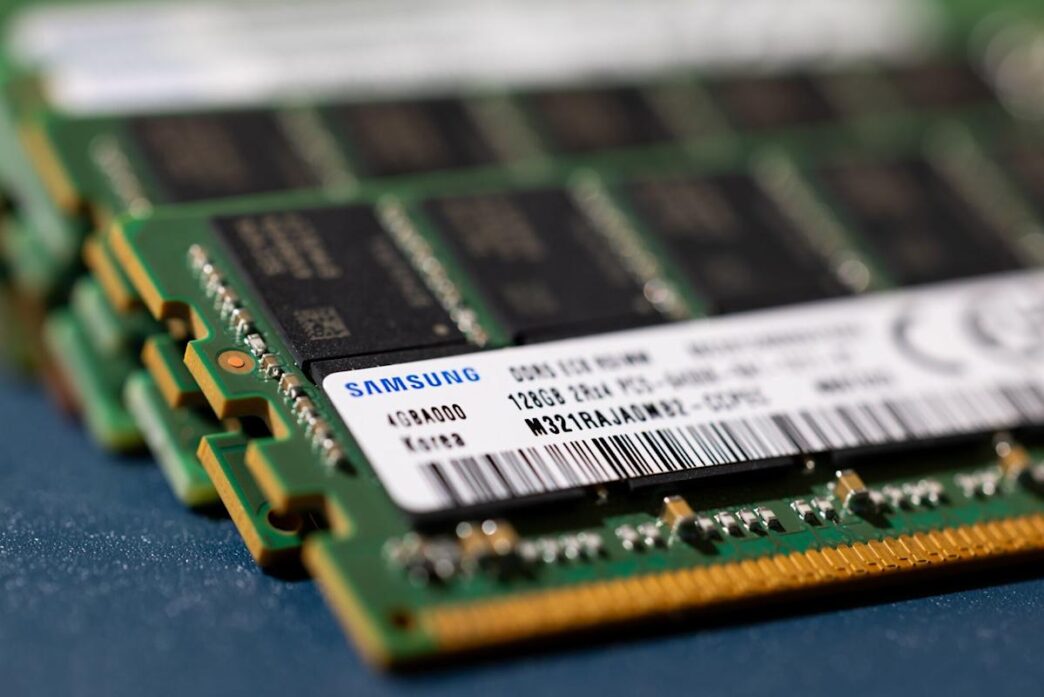

Samsung just landed a $16.5 billion deal to make AI chips for Tesla. The contract covers Tesla’s next-gen AI6 chip and will run through 2033. Production will take place at Samsung’s new Texas fab in Taylor.

Tesla CEO Elon Musk confirmed the news on X, saying the deal is “just the bare minimum” and actual output may be several times higher. Musk also said he’s authorized to walk the chip fab floor and help optimize production.

The strategic importance of this is hard to overstate.

— Elon Musk

Samsung’s shares jumped 6.8% in Seoul, hitting their highest since last September. Suppliers like Soulbrain surged 16%. Samsung declined to comment due to contract confidentiality.

This deal is a big win for Samsung’s struggling foundry division, which has been underutilized and loss-making. The Texas fab’s ramp-up was delayed to 2026, but this Tesla contract could boost foundry sales by about 10% yearly, according to analysts.

Samsung trails Taiwan Semiconductor (TSMC), which controls 67.6% of the global foundry market. Samsung’s share dropped to 7.7%. But both Samsung and TSMC are pushing toward 2-nanometer chip production.

Tesla’s AI6 chip will power its driving hardware for the next several years. Musk noted Tesla’s current AI4 chips also come from Samsung, but the company plans to briefly source AI5 chips from TSMC before switching fully to AI6.

This rapid chip lineup shakeup could frustrate Tesla owners. In early 2023, Musk said Tesla would stop retrofitting older cars with new chips due to cost and complexity.

Tesla is ramping its self-driving efforts, launching a robotaxi service in Austin, but fully driverless rides remain pending. The Full Self-Driving system still requires driver supervision.

This Samsung contract signals renewed confidence in its foundry technology and positions the company as a top alternative to TSMC in the semiconductor race.

The $16.5 billion contract spans 2025-33 and could boost Samsung’s foundry sales by 10% annually, we calculate.

— Masahiro Wakasugi and Takumi Okano, Bloomberg Intelligence