AI funding hits $110B in 2024. Competition heats up for 2025. Early-stage startups face an influx of cash but more pressure to prove themselves.

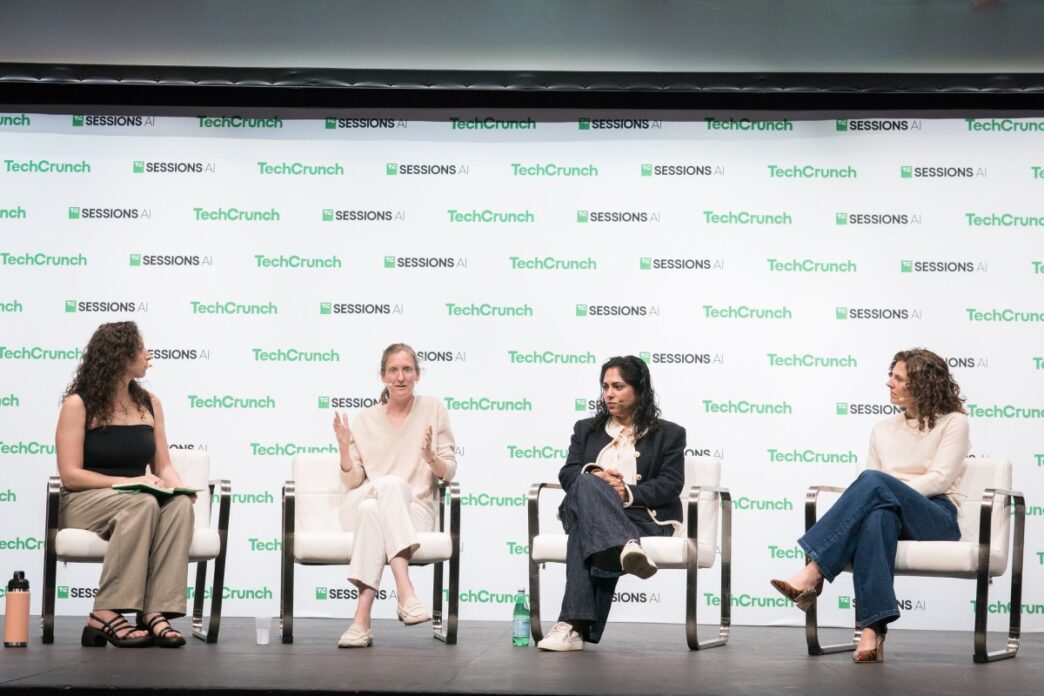

At TechCrunch Sessions: AI, investors Jill Chase (CapitalG), Kanu Gulati (Khosla Ventures), and Sara Ittelson (Accel) laid out what matters now for seed to Series C AI startups.

The bottom line: forget nailing the perfect pitch. Build trust. Survive hype cycles. Brace for copycats as soon as you nail product-market fit.

Key takeaways from the Equity podcast episode:

- VCs want real relationships, not flawless slides.

- Going up against big players means staying sharp and fast.

- Speed and consumer focus still win, even in B2B AI.

- Agents and automation are already changing startup strategies.

Equity drops new episodes Wednesdays and Fridays. Catch the full discussion on Apple Podcasts, Spotify, Overcast, and follow @EquityPod on X and Threads.

Jill Chase stated:

Forget the perfect pitch.

Focus on building trust.

Survive hype cycles.

Be ready for copycats right after you find product-market fit.

Kanu Gulati added:

Speed and consumer focus win, even in B2B AI.

Agents and automation are already reshaping startup playbooks.

Sara Ittelson emphasized:

Relationships matter more than slides.

Competing with incumbents means being sharper and quicker.