Huawei is racing to close the gap with Nvidia in AI chip design amid tight US export restrictions. The US has blocked China from accessing advanced AI chips and key manufacturing tech. This limits China’s ability not just to buy top chips but also to build a full AI chip ecosystem.

Huawei’s HiSilicon is the Chinese front-runner. Its Ascend 910B GPU is two years behind Nvidia’s tech, but the next-gen Ascend 910C is reportedly just one year behind Nvidia’s export-limited H20 chip. Dylan Patel, CEO of SemiAnalysis, said:

Compared to Nvidia’s export-restricted chips, the performance gap between Huawei and the H20 is less than a full generation. Huawei is not far behind the products Nvidia is permitted to sell into China.

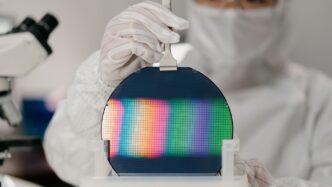

Nvidia relies on foundries like TSMC, which are blocked from working with Huawei due to US blacklisting. China’s SMIC foundry struggles to match TSMC’s advanced 3nm process, peaking around 7nm with questionable yields. SMIC may have produced a 5nm 5G chip for Huawei’s Mate 60 Pro, but is far from mass-producing cutting-edge GPUs.

Advanced chipmaking gear is another bottleneck. Netherlands-based ASML supplies critical lithography machines needed for sub-7nm chip production. But US restrictions have stopped ASML from selling its top EUV lithography tools to China. SemiAnalysis analyst Jeff Koch put it bluntly:

They have most of the other tooling available, but lithography is limiting their ability to scale towards 3nm and below process nodes.

Chinese companies like SiCarrier Technologies are reportedly working to develop their own lithography tech, but experts say it could take years or decades.

Memory chips also lag. High bandwidth memory (HBM) is essential for AI, but China’s CXMT is three to four years behind leaders like SK Hynix and Samsung. CXMT is still ramping production and faces export controls on essential equipment.

Chinese foundry Wuhan Xinxin Semiconductor is building an HBM factory, reportedly with Huawei’s backing. Meanwhile, Huawei still relies on existing Samsung HBM stockpiles for the Ascend 910C.

Paul Triolo of DGA-Albright Stonebridge Group summed up China’s challenge:

U.S. export controls on advanced Nvidia AI chips have incentivized China’s industry to develop alternatives, while also making it more difficult for domestic firms to do so.

China has pumped tens of billions into semiconductor development. The progress is real but uneven. China’s AI chip ambitions are advancing, but production scale, advanced manufacturing, and memory tech remain major hurdles under global export restrictions.