Apollo Global Management economist Torsten Sløk is warning the AI stock boom is hitting bubble territory.

Sløk flagged that the price-to-earnings ratios (P/E) of the 10 largest S&P 500 companies — including AI favorites like Meta and Nvidia — have surpassed levels last seen during the 1999 dot-com bubble.

The issue: These megacap tech giants now make up almost 40% of the S&P 500. Investors buying the index are heavily exposed to just a few AI plays.

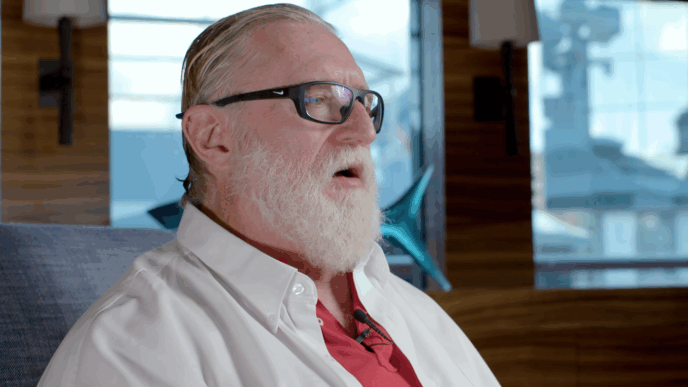

Torsten Sløk stated on Yahoo Finance’s Opening Bid:

"Yes, AI will do incredible things for all of us," Torsten Sløk, chief economist at Apollo Global Management, said on Yahoo Finance’s Opening Bid. "But does that mean I should be buying tech companies at any valuation?"

"Almost 40% of the S&P 500 is made up by the 10 largest companies," he said. "So if I take $100 as an investor and buy the S&P 500, I think I have exposure to 500 different stocks, but I’m really just betting on the Nvidia and the AI story continuing."

Sløk’s research note warns current valuations in these megacap stocks may not last.

BTIG analysts backed up these concerns, calling market sentiment around AI stocks “frothy.” The BUZZ NextGen AI Sentiment Index — tracking retail-favored AI stocks — has surged 45% over 16 weeks and is now 29% above its 200-day moving average, the highest since early 2021’s tech peak.

BTIG’s Jonathan Krinsky weighed in:

"Can it get more so like it did in ’20-’21? Of course," BTIG analyst Jonathan Krinsky wrote. "But tactically, this feels a bit extreme to us."

Krinsky also warned that the index’s top holdings, including Rocket Lab (RKLB), Coinbase (COIN), and Unity Software (U), are showing "vertical" chart patterns and are increasingly vulnerable to "short-term shakeouts."

BTIG recommends rotating into safer bets like utilities or Chinese tech, which has been in consolidation mode.

The takeaway: Wall Street’s split between long-term AI optimism and short-term valuation worries is growing. Bubble alert? Investors might want to rethink how much AI exposure they want, fast.