Alaan just raised $48M in Series A to scale its Middle East spend management platform.

The round is led by Peak XV Partners (ex-Sequoia India & SEA), with backing from Y Combinator, 885 Capital founders, and regional celebrities like YouTuber Khalid Al Ameri. It’s one of the largest fintech Series As in MENA, trailing only behind Saudi BNPL giant Tamara’s $110M.

The startup was founded by ex-McKinsey consultants Parthi Duraisamy and Karun Kurien. Duraisamy struggled personally with corporate card acceptance in the region, fueling Alaan’s creation.

Alaan’s biggest hurdle: regulatory red tape. It took almost a year post-seed to launch in the UAE, and years to get Saudi approvals before opening shop there in January. The CEO said the main challenge was simply going live.

“The biggest challenge we faced, both in the UAE and Saudi Arabia, was simply going live,” Duraisamy shared.

Alaan leads the regional spend management market and was the first to integrate Apple Pay into B2B tools in MENA. The company also pioneered OpenAI integration early 2023, starting with a chatbot that flopped. They pivoted AI to back-end finance automation like receipt matching, reconciliation, and VAT extraction—a big help in complex tax environments.

The platform claims to have saved finance teams over 1.5 million hours of manual work. It’s already processed 2.5 million transactions for 1,500+ finance teams at major players like G42, Careem, Tabby, and Lulu Group.

Alaan is profitable, converting $5M spent into $10M revenue. Duraisamy credits YC for instilling financial discipline in a market where others chase volume.

The fresh $48M will accelerate growth in Saudi Arabia and fuel hires in sales, customer success, and compliance. AI-driven automation remains a core focus.

Duraisamy downplayed comparisons to US fintech Ramp’s recent explosive valuation growth, emphasizing fundamentals over market size.

“When you talk to investors, what really matters for a company at our stage is the fundamentals: how capital-efficient we are, how much revenue we generate, how strong our go-to-market motion is,” he said.

“We are not in a market where you know size is an advantage, like the US or Europe. So, regardless of whether Ramp was able to raise or not, I think we would have raised this much because our fundamentals were very strong.”

The company plans continued AI investment as it doubles transaction volumes monthly in Saudi Arabia.

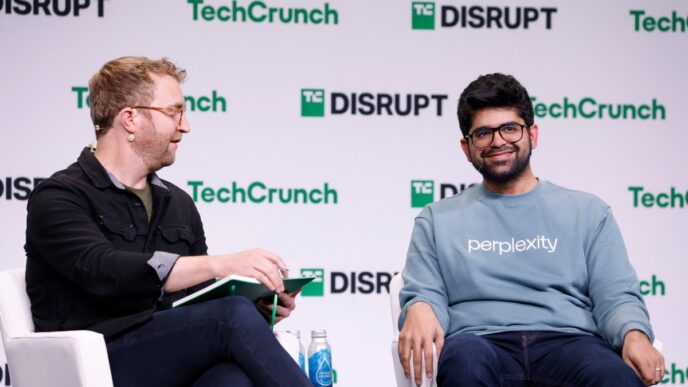

TechCrunch event

San Francisco | October 27-29, 2025