European banks are pivoting to AI and cloud technology in a major strategic shift from cost-cutting to innovation. This move responds to fierce demand for AI, which is becoming essential in banking operations.

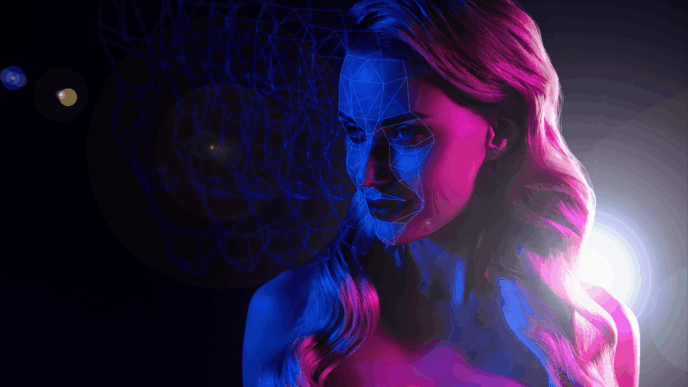

According to recent findings, 28% of European banks report that AI notably enhances fraud detection and customer service. These are crucial under the region’s strict regulatory requirements.

AI chatbots and virtual assistants are now streamlining customer interactions, delivering personalized engagement, and optimizing operational costs. Despite this progress, nearly half of AI initiatives remain in early phases, stalled by data management and regulatory hurdles.

Generative AI could add between $200 billion and $340 billion annually to banking productivity. ABN Amro is using generative AI to summarize customer calls, improving contact center efficiency. Meanwhile, JP Morgan has decreased payment validation errors by up to 20% with AI models.

However, data privacy and security pose significant challenges. Over half of banks believe their data architecture is AI-ready, yet implementing AI remains a struggle.

Innovation is key to customer loyalty today. Banks must adapt to meet growing demands for AI and cloud technology talent. But recruiting skilled professionals is tough, especially with global banks competing for the same talent pool.

Efforts are underway. The European Commission’s AI Continent Action Plan aims to enhance AI education and training, while banks invest in reskilling initiatives.

Strategic partnerships are emerging as a solution. BNP Paribas collaborates with AI startups, and Lloyds Banking Group partners with the University of Cambridge for AI training.

Digital transformation is crucial. Banks that successfully invest in AI and cloud technologies will boost efficiency and customer experience. While challenges remain, those banks that balance innovation with risk management are poised to lead in the evolving financial landscape.

The Infosys Bank Tech Index highlights varying bank priorities and spending trends in technology across nearly 400 global banks.

Jay Nair

Executive Vice President and Industry Head for Financial Services in Europe, Middle East, and Africa| Infosys

About The Author:

Jay Nair leads Infosys’ financial services in Europe, Middle East, and Africa. With nearly 30 years in engineering and banking, he boasts extensive expertise in technology consulting and enterprise-wide program management.