Nvidia just dropped massive Q2 earnings: $46.7 billion revenue, up 56% year-over-year. AI-driven data center sales powered the surge, with revenue hitting $41.1 billion — a 56% jump.

Net income soared 59% to $26.4 billion. Nvidia’s Blackwell chips accounted for $27 billion of data center sales, cementing their dominance in AI hardware.

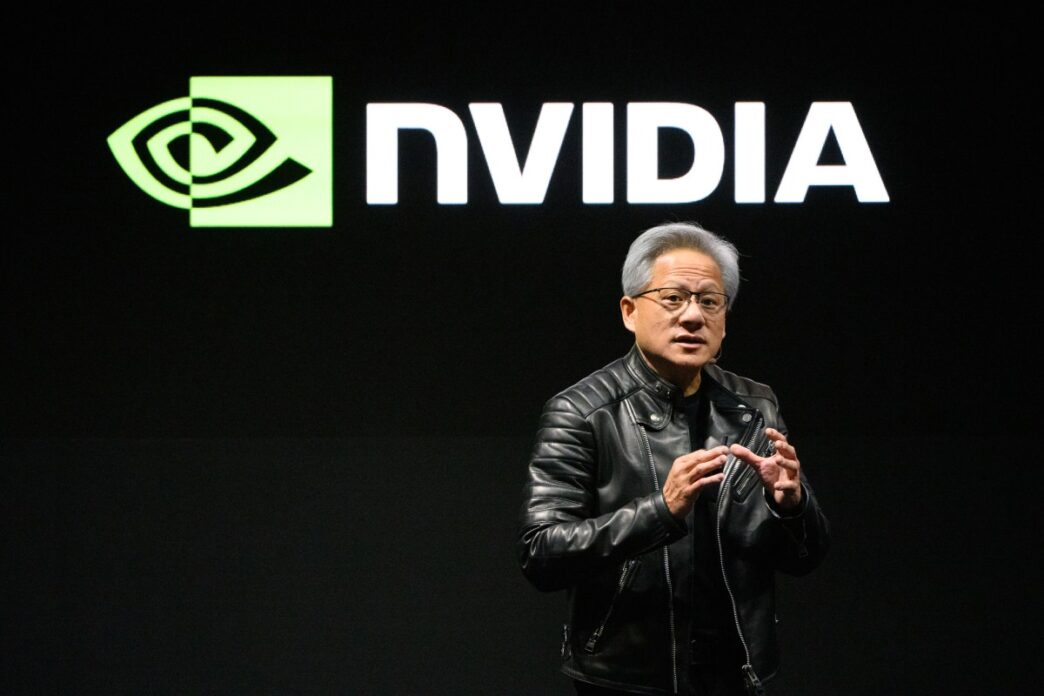

CEO Jensen Huang doubled down on Blackwell’s role in the AI boom.

“Blackwell is the AI platform the world has been waiting for,” Huang said.

“The AI race is on, and Blackwell is the platform at its center.”

The earnings flagged ongoing friction in China. No sales of Nvidia’s China-focused H20 chip to Chinese customers this quarter. $650 million in H20 sales went to non-China customers instead.

The U.S. lets Nvidia sell chips to China only under a 15% export tax, an unusual setup court experts call “an unconstitutional abuse of power.” Nvidia CFO Colette Kress said shipments stalled due to unclear regulations and licensing delays.

“While a select number of our China-based customers have received licenses over the past few weeks,” Kress said,

“we have not shipped any H20 devices based on those licenses.”

China’s government has officially discouraged Nvidia chip use, pushing Nvidia to halt H20 production earlier this month.

Nvidia expects Q3 revenue around $54 billion, excluding any H20 China shipments. The company is clearly betting on AI demand worldwide but stuck navigating geopolitical hurdles.