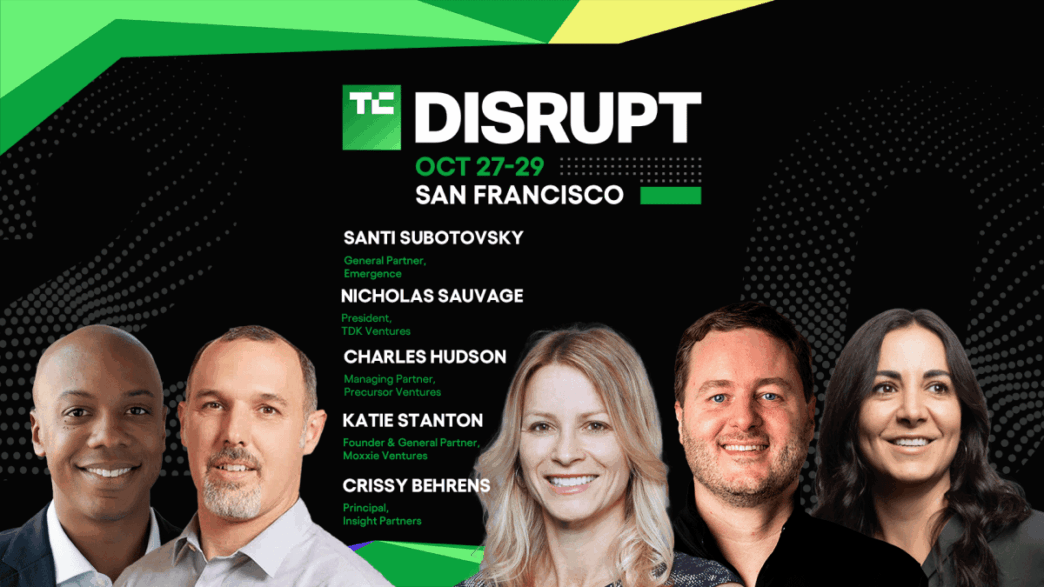

TechCrunch just added five heavyweight VCs to the Startup Battlefield 2025 judging panel. The next wave of judges will hit the Disrupt stage in San Francisco, October 27–29. They’re here to grill founders and help pick the $100,000 winner.

Here are the fresh faces:

Crissy Behrens, Principal at Insight Partners, backs high-growth SaaS, DevOps, and infrastructure startups. She’s got a track record from seed to IPO, with a background in go-to-market for B2B startups.

Charles Hudson, Managing Partner at Precursor Ventures, focuses on early-stage bets, investing in over 400 companies. His portfolio includes The Athletic (sold for $525M to NY Times) and Modern Health.

Nicolas Sauvage, President at TDK Ventures, leads a $350M fund targeting digital and energy startup innovation. TDK Ventures has backed 45 startups including unicorns like Ascend Elements and Groq.

Katie Stanton, Founder and GP at Moxxie Ventures, has Silicon Valley exec chops at Twitter, Google, and Yahoo, plus White House experience. She’s invested in 100+ early-stage startups including Coinbase and Airtable.

Santi Subotovsky, General Partner at Emergence Capital, led the early Zoom investment and sits on multiple boards. Emergence is a veteran B2B tech investor with major hits.

TechCrunch Disrupt 2025 promises to be the ultimate startup pitch showdown. More than 10,000 startups and VCs will converge on Moscone West to launch and scale tomorrow’s tech. Tickets are still on sale — grab yours before prices go up.

Crissy Behrens joined Insight Partners in 2021 to focus on investments in high-growth software businesses across SaaS, DevOps, and infrastructure. She previously spent time at Primary Venture Partners as a seed investor and at B Capital Group as a growth investor. Across her investing career, Behrens has partnered with companies at every stage of growth, from pre-seed to IPO.

Before becoming an investor, Behrens worked in go-to-market roles at several B2B startups and developer platforms. These customer-facing roles gave her invaluable problem-solving skills that have made her a true partner to the founders and entrepreneurs she invests in.

Charles Hudson is the managing partner and founder of Precursor Ventures, an early-stage venture capital firm focused on investing in the first institutional round of investment for the most promising software and hardware companies. He invests in people over product at the earliest stage of their entrepreneurial journey. Under his leadership, Precursor has raised four funds and has $250+ million under management. He has invested in over 400+ companies and has supported 450+ founders, including the teams behind Bobbie Baby, Carrot, Incredible Health, Juniper Square, Modern Health, Pair Eyewear, Rad AI, and The Athletic (sold to the NY Times for $525 million in 2022).

Image Credits: Haje Kamps/TechCrunch

Nicolas Sauvage is president of TDK Ventures, the corporate venture capital arm of TDK Corporation, where he leads the firm’s $350M mandate to invest in early-stage startups driving digital and energy innovation. Since its founding in 2019, TDK Ventures has backed 45 startups under its leadership, including three unicorns — Ascend Elements, Groq, and Silicon Box.

Recognized globally, Sauvage has appeared on the GCV Powerlist for six consecutive years, most recently ranking #17 among the top 150 heads of corporate venture. He is also one of only two corporate VCs inducted into the prestigious Kauffman Fellows program.

Katie Stanton is the founder and general partner of Moxxie Ventures, an early-stage venture fund. Prior to Moxxie, Stanton served in numerous executive operating roles at Twitter, Google, Yahoo, and Color. In addition to working in Silicon Valley, Stanton served in the (Obama) White House and State Department and began her career as a banker at J.P. Morgan Chase. Stanton sits on the Board of Vivendi, a French multinational media company headquartered in Paris, and previously served on the Board of Time Inc. She started her venture career as a founding partner of #Angels and has invested in over 100 early-stage companies including Airtable, Calm, Cameo, Carta, Coinbase, Literati, Modern Fertility, and Shape Security.

Santi Subotovsky is a general partner at Emergence Capital, where he has been a driving force behind some of the firm’s most successful investments since joining in 2010, including Chorus and Openpath. He led Emergence’s investment in Zoom (NASDAQ: ZM) when it was a little-known startup and remains on its board as the company stands as a $24 billion market cap giant. He also serves on the boards of leading companies like Crunchbase, Logik.io, Zipline, Tundra, and Class, and works closely with startup studio and accelerator High Alpha, and Quasar Ventures, which helps Latin American entrepreneurs bring disruptive ideas to life.

TechCrunch Disrupt 2025

San Francisco | October 27-29, 2025

Secure your ticket now before prices rise.