Wall Street’s AI trade rebounds as Q2 earnings top expectations

More than half of S&P 500 companies have reported Q2 earnings, showing a solid 9.8% year-over-year growth, up from 5.8% just weeks ago, according to LSEG data.

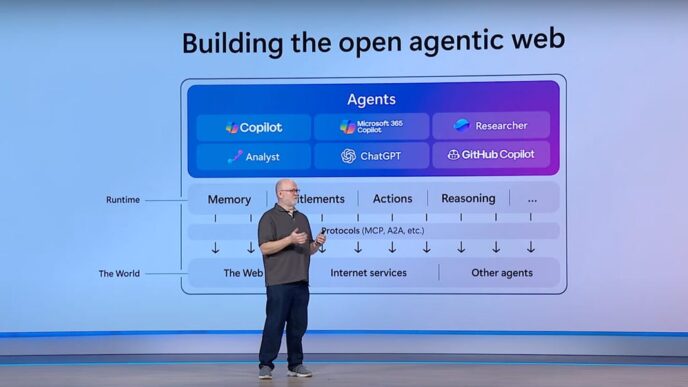

The earnings boost has lifted stocks near record highs, driven by tech and AI-focused giants like Microsoft and Meta Platforms. Their strong profit reports confirm investor bets on AI are paying off.

81% of companies beat analyst expectations, beating the four-quarter average of 76%. Investors are gaining confidence after last quarter’s tariff fears and economic worries.

Tim Ghriskey, senior strategist at Ingalls & Snyder, noted:

“The first quarter was a bit more mixed and you had some questionable economic data … which I think gave the market some pause.”

“But the second quarter seems to have just been a turnaround.”

Art Hogan, chief strategist at B. Riley Wealth, said:

“The earnings season has been unambiguously better than expected.”

The Q2 strength reassures investors sidelined by earlier jitters fueled by the rise of Chinese AI startup DeepSeek, which sparked fears over increased competition against established leaders like Nvidia.

Viresh Kanabar from Macro Hive says worry over AI demand appears exaggerated. Despite a 6% gain in the S&P 500 this year, institutional investors remain only modestly overweight equities, per Deutsche Bank.

Next week, focus turns to Dow names Disney, McDonald’s, and Caterpillar for clues on the broader economy. Strong reports here could push the Dow to a new peak.

Hogan adds:

“If you are trying to beat your benchmark and you were underweight any of the AI names you have to chase them.”

But August and September could bring volatility, driven by new U.S. tariffs, mixed Amazon earnings, and softer payrolls reports. Hogan calls any dips “buying opportunities,” especially in mega-cap tech stocks.

Alphabet, Microsoft, Nvidia, Meta, and Amazon make up roughly 25% of the S&P 500’s weight. Their health is critical for the market overall.

Kanabar sums it up:

“We’re not saying the weakness isn’t there in other parts of the economy.”

“We’re just saying at the index level, the largest companies dominate to such an extent (that) it doesn’t matter to some at the moment.”