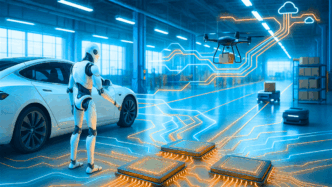

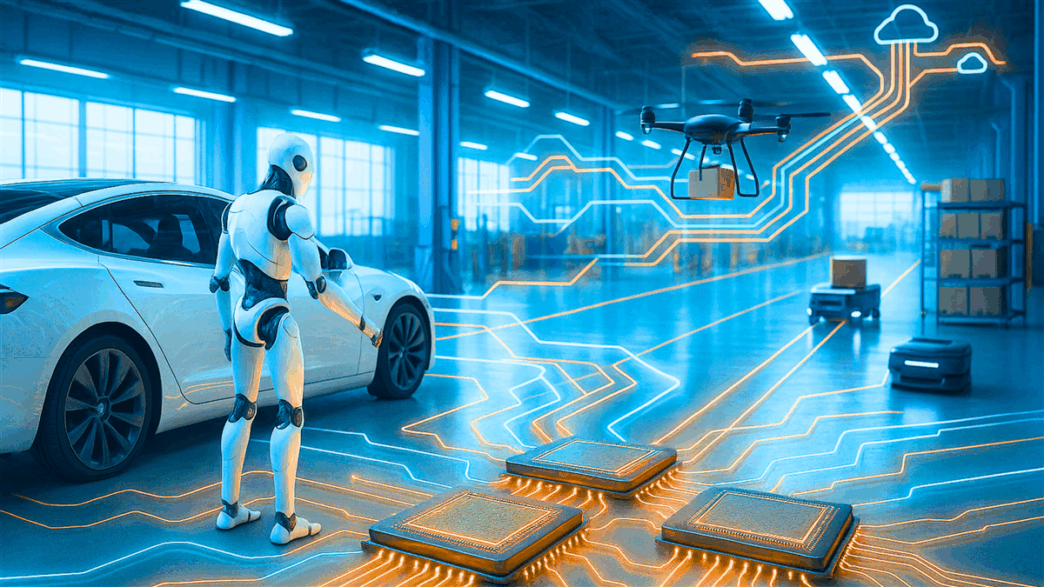

NVIDIA, AMD, Tesla, Ambarella, and Symbotic are shaping physical AI in 2025 and beyond.

NVIDIA sticks to its lead with GPUs powering AI from data centers to smart cities. The stock trades at $170.78, up 2.25%, with a price target of $181.22. Analysts see potential for a 200% gain over the next decade. NVIDIA expands aggressively into automotive, robotics, and infrastructure for real-time AI.

AMD is ramping up AI at the edge with its Ryzen line, featuring neural processors for devices. Stock hits $158.65 (+2.54%), priced slightly above the $154.68 target. AMD is undervalued but poised for triple-digit gains thanks to improved memory and data center performance.

Tesla faces challenges with Musk’s image and competition but pushes full autonomy with the upcoming Cybercab and the Optimus robot active in Gigafactories. Stock is $332.56, little changed, with a $298.97 target. Tesla could double long term despite short-term headwinds.

Ambarella shifts from image processing to computer vision and edge AI with chips that handle high-res video and analytics. It returned to growth in 2024 and forecasts high double-digit growth for years. Shares stand at $68.01, slightly down, with an $83.64 price target and 100% upside potential.

Symbotic automates supply chains for Walmart, Amazon, and others, delivering robots and platforms that boost efficiency and cut emissions. The stock surged 9.47% to $54.08, above its $39.94 target, as it mills through a $23 billion backlog. Growth is just starting.

MarketBeat alerts that NVIDIA is a Moderate Buy, but top analysts say other physical AI stocks are stronger buys right now.

Get the full list here.

Physical AI is no longer tomorrow’s promise. It’s here, and these players are the ones to watch.