Nvidia is back to selling its AI chips to China after a major U.S. policy reversal.

The Trump administration flipped on blocking Nvidia’s H20 chip exports to China. The reason? Nvidia’s not handing over its top-tier tech. Instead, China gets the "fourth best" chip—not the fastest or most advanced models.

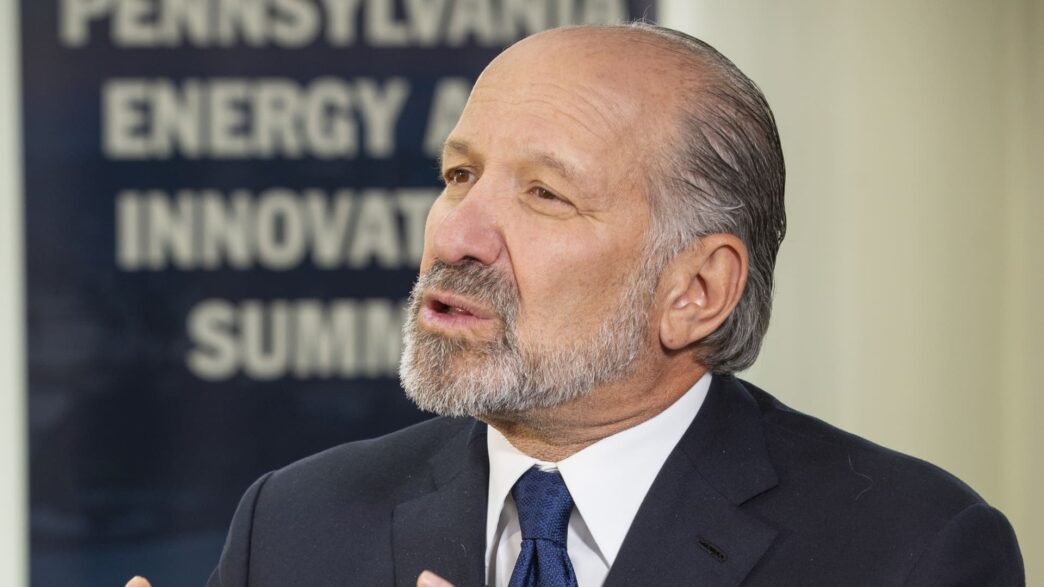

Commerce Secretary Howard Lutnick told CNBC that Nvidia deliberately slows down chips for China.

"We don’t sell them our best stuff, not our second best stuff, not even our third best," Lutnick said.

The U.S. decision came after President Trump met Nvidia CEO Jensen Huang. Lutnick explained it’s a strategic move to keep Chinese developers addicted to American tech. He also linked the chip sales to a rare earth magnets deal, reinforcing U.S. interests in maintaining the tech gap.

"The fourth one down, we want to keep China using it," Lutnick added.

"You want to sell the Chinese enough that their developers get addicted to the American technology stack."

Huang backs the move, pushing for continued sales to slow China’s homegrown AI chip development. He also said Nvidia’s chips aren’t likely to end up in Chinese military hands.

The H20 chip launched in 2022 as a response to export controls. It’s weaker than Nvidia’s U.S. Hopper-generation chips (H100, H200), dropping GPU cores and bandwidth. But Chinese firms like DeepSeek still find it useful.

The ban had hit Nvidia hard: the company expected $8 billion in H20 sales this quarter before restrictions.

This reopening means Nvidia keeps its foothold in China, while introducing newer Blackwell chips in the U.S. cloud and data centers. Blackwell Ultra is rolling out now, with "Vera Rubin" chips slated for 2027.

China’s AI chip market just got a locked-in U.S. entry point—but only at a carefully controlled tech level.