Nvidia has crushed it with a 1,400% surge in stock value over five years. The AI chip leader is still firing on all cylinders and here’s why it remains a top buy.

Founding CEO Jensen Huang keeps steering Nvidia from gaming chips to AI dominance. His vision is paying off big time.

Nvidia just posted $130 billion in revenue last fiscal year. That’s back-to-back quarters of double- and triple-digit growth.

Profit margins are killer. Gross margins have topped 70% consistently, even during big product launches. Growth without profitability? Not here.

Innovation stays front and center. Nvidia rolls out updated chips yearly. The Blackwell architecture just dropped this winter, and Blackwell Ultra is now launching. They have a roadmap locked down through 2028.

Nvidia covers the full AI stack, from training to inference and building AI agents. Industry-specific platforms span healthcare, automotive, and more. This wide reach cements its grip on the AI boom.

The company’s AI empire serves as a strong moat. No competitor offers such a full portfolio. Catching up isn’t happening overnight.

Nvidia adapts fast. Recent export controls on China blocked their H20 chip sales. They also reacted to tariffs with major U.S. manufacturing investments. This adaptability is a big plus going forward.

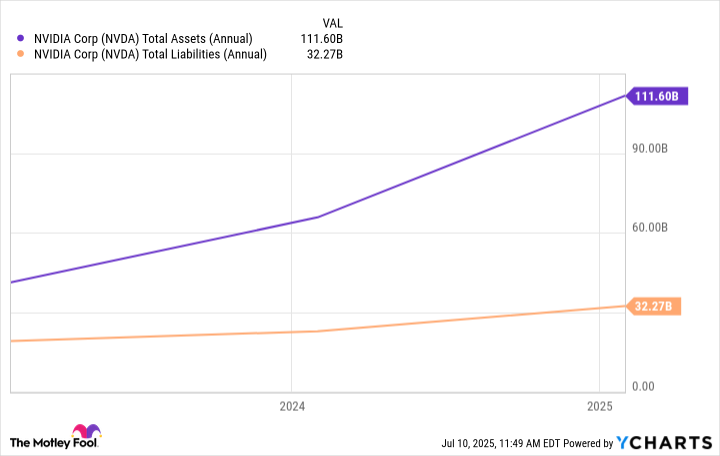

Cash flow is solid. Over $53 billion in cash and assets far outpace liabilities.

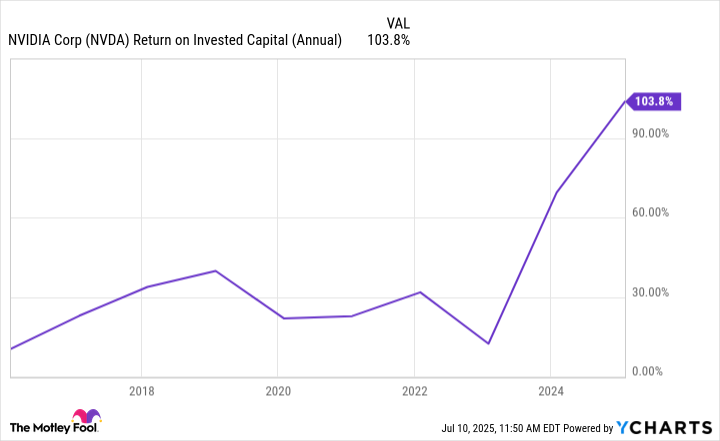

Investment decisions have been smart. Return on invested capital has surged alongside AI demand. New products now make Nvidia systems easier to use, broadening their user base.

The stock looks like a steal. It trades at 37 times forward earnings, down from 50 times just months ago. Entry point for long-term holds? Prime time.

Image source: Getty Images.

NVDA Total Assets (Annual) Chart by YCharts

NVDA Return on Invested Capital (Annual) Chart by YCharts