OpenAI reports 10% of global systems now use its AI products. Fortune 500 firms are rolling out CEO mandates to integrate AI fast.

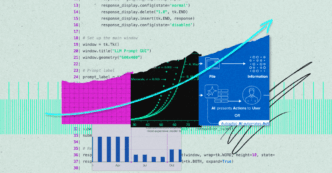

After ChatGPT’s 2022 release, many thought AI apps were just cheap “GPT wrappers.” Turns out, building flash demos is easy. Real AI products are way harder. User data is messy. Models hallucinate. Enterprise clients in sectors like accounting and legal demand high accuracy and trust. AI companies invest heavily in engineering to deliver reliable, customized solutions.

“Demos have always been simplistic versions of a final product, but the demo-to-product gap is even wider with AI products because of the constantly evolving models and their nondeterministic outputs.”

Building strong AI products means juggling multiple models, fine-tuning small ones, and tailoring to each customer’s unique setup. No single API call does it all.

AI startups are growing at record speed. Hitting $1M ARR in the first year was once a big deal. Now it’s below median for Series A AI startups. Some firms are hitting $5M ARR faster than classic SaaS companies. Cursor is one of the fastest growing software brands ever, boosting growth with product-led sales.

Why? Enterprises want AI and have dedicated budgets. They’re actively pulling AI into workflows. Plus, AI replaces labor budgets, so contract values are huge.

OpenAI just slashed prices on its o3 model 80%. AI app-building costs fell from $30 to under $5 per million tokens in two years. Developer tools like Cursor and no-code platforms like Lovable and Replit speed up app creation.

Expect tons of new AI apps, serving niche workflows and personal markets. AI is unlocking tools that were once uneconomical or too complex.

Speed is king. Early movers snag brand dominance and big deals before rivals can react. Cursor’s fast rollouts make it a household name in coding tools, even influencing hiring at Canva. Other startups like Decagon, ElevenLabs, Hebbia, and Harvey ride early momentum to lock in enterprise customers.

Legacy incumbents and model providers try to compete but often split focus. Laser-focused AI natives still win adoption battles.

Moats remain key. Pure AI tech isn’t enough to protect a business long-term.

Most durable plays build as systems of record or own critical workflows. Companies like Eve, Salient, and Toma use AI wedges to capture unique data and evolve into core platforms. Workflow lock-in also matters; Decagon’s hybrid human-AI support agents create sticky processes.

Deep vertical integrations pay off. Tennr links to legacy healthcare systems. HappyRobot hooks into homegrown logistics platforms. Glean locks into core enterprise apps. These bespoke ties are tough to replace.

Strong customer relationships and positioning as strategic AI partners seal deals too.

“Enterprise buyers are still human. Trusted relationships often matter more than any specific feature or vendor price…”

AI builders are racing. The space demands rapid scaling, deep integrations, and solid moats to win big. The AI boom is here — and it’s rewriting software playbooks fast.