Luminar is set to boost its finances with a new deal worth $200 million. The lidar company announced a regulatory filing on Wednesday, detailing a sale of convertible preferred stock to Yorkville Advisors Global and an unnamed investor over 18 months.

The agreement enables Luminar to issue an initial $35 million in preferred stock, with subsequent tranches of up to $35 million available every 60 days. However, Luminar isn’t obliged to issue these additional shares.

"Today’s transaction provides us with additional financial flexibility and further strengthens our balance sheet," Luminar CFO Tom Fennimore stated.

"We’ve made substantial progress in extending our liquidity runway with our restructuring efforts, and the additional capital available to us under this facility provides us with another tool to realize our long-term value."

The funds from this first issuance will primarily go towards general corporate purposes and debt retirement.

This move comes on the heels of a significant leadership shakeup. Earlier this month, Luminar’s board ousted founder Austin Russell as CEO, appointing Paul Ricci, the former CEO of Nuance, in his place. The company has also initiated another round of layoffs, marking its third since spring 2024.

Yorkville Advisors has a history of providing similar lifelines to struggling firms, including the likes of Lordstown Motors and Faraday Future.

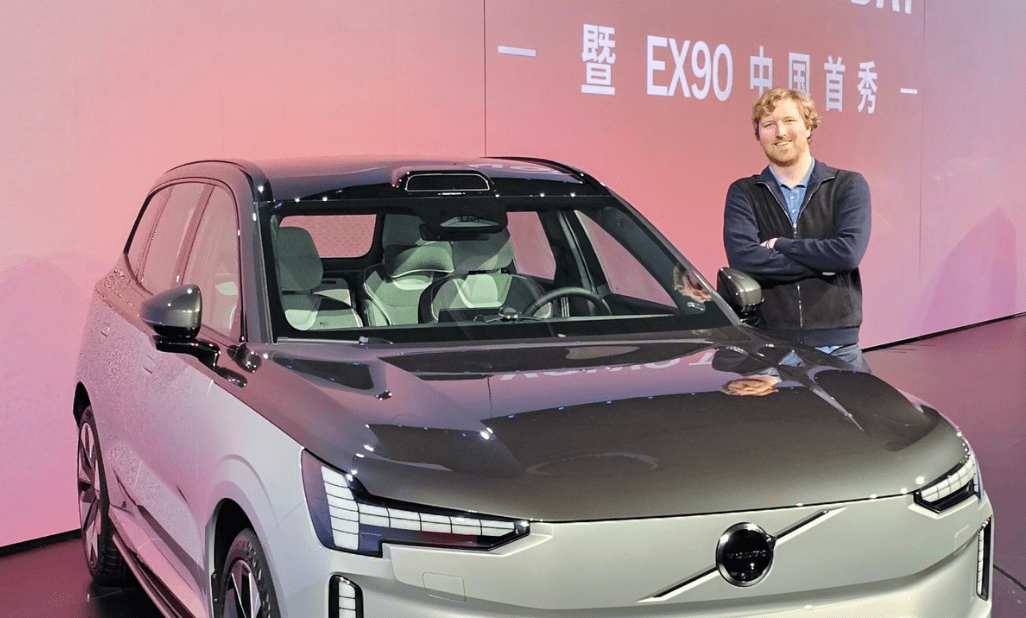

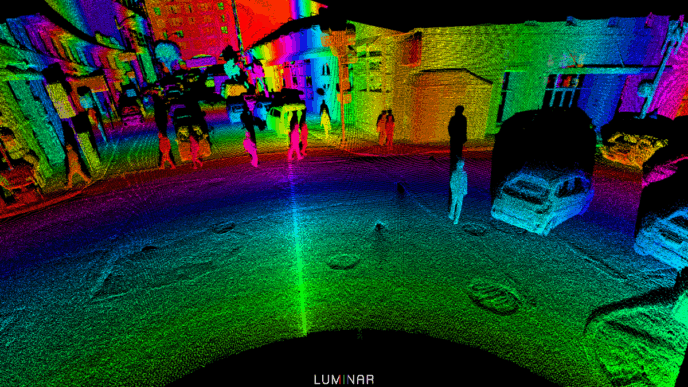

Founded by Russell in 2012, Luminar gained prominence during the autonomous vehicle hype cycle. It merged with Gores Metropoulos Inc. in 2021, achieving a valuation of $3.4 billion. Now, its market cap sits at just $179 million.

Luminar has faced repeated restructuring. In 2024, it cut approximately 30% of its workforce. Recent layoffs began on May 15, expected to incur cash charges of $4 million to $5 million in the second and third quarters.

The situation remains fluid as Luminar navigates its financial hurdles.